🚀 Inside the Minds of VCs: How UK Funds Evaluate Startups (Part IV of IV)

Part IV of IV — A Deep Dive into Pre-Investment Decision-Making in Frontier Tech

Welcome to 22nd Century Frontier — your strategic edge in innovation, investment, and entrepreneurship. ⚡

"Audentes Fortuna Iuvat"

~ Latin Proverb

In Part III, we mapped the UK blockchain landscape in unprecedented detail—517 funding rounds, 220 startups, and five proprietary deal-sourcing strategies VCs quietly deploy. We traced the full pre-investment journey, from a founder’s first Zoom pitch to multi-hour site visits and the Investment Committee’s decisive term-sheet call.

Now, in Part IV, we move from the where and how of deal flow to the why behind investment decisions. This is the unspoken heart of venture capital—the blend of instinct, psychology, and hard metrics that determines who gets backed and who gets passed over. We’ll show you why founder and team quality dominates every ranking, how the “seven pillars” of screening interlock into a due diligence engine, and the make-or-break hurdles most founders never see coming.

From deep-tech validation to the quirks of blockchain governance, from deal-killing red flags to the post-investment role of a VC in token economies—this isn’t just theory. It’s the art and science of venture investing, revealed in full for the first time.

What You’ll Discover in This Series:

Part I: Laying the Foundations

Setting the Stage: A historical primer on UK PE/VC evolution, the mystery we set out to solve, our four guiding research questions, the three‑stage field‑based methodology, and how each part of this series builds your ultimate VC playbook.

Part II: Decoding the VC Screening Playbook

Demystify the full VC playbook: From why they back pre‑revenue startups and how they outpace public markets, to the seven screening pillars that narrow hundreds of pitches down to the few they back—complete with data‑driven rankings and candid insights from four UK fund partners.

Part III: Unveiling the Findings & Discussion

Navigate the UK VC Playbook: We’ll chart the UK frontier‑tech ecosystem, uncover the five proprietary deal‑sourcing strategies VCs use, guide you step-by-step through their pre‑investment process and seven core screening pillars, and reveal the unique twists in evaluating blockchain ventures versus traditional startups.

Part IV: Mastering VC’s Art vs. Science

VC’s “Art vs. Science” Screening: Why 7 out of 7 VCs rank founder & team quality as their #1 filter—and how they blend subjective judgment, reference checks, and gut instinct to assess drive, integrity, and domain expertise.

The Seven Pillars Ranked: See our combined ranking of the core screening criteria—team, product/technology, market size & growth, competition & barriers, portfolio fit, business model, and exit case—and learn how each feeds into a rigorous due‑diligence engine.

Beyond the Pitch Deck: Discover the additional hurdles—deep‑tech validation, GTM strategy scrutiny, market‑sizing rigor, and “if you need an agent, it’s a red flag” deal killers—that VCs apply before term‑sheet stage.

Blockchain’s Due‑Diligence Curveballs: Unpack the unique twists—crypto‑valuation workarounds when DCF fails, fluid regulatory frameworks across jurisdictions, and token‑governance models instead of board seats—that set blockchain ventures apart.

Post‑Investment Playbook: Learn how VC engagement changes after signing—why “you’re not just a shareholder but a network steward” in token economies, and how continuous protocol‑level voting replaces quarterly board meetings.

This is the kind of intelligence we created 22nd Century Frontier to deliver: original research, untold insights, and decision-making frameworks you can’t find in public databases or news feeds.

Let’s dive into Part IV.

Premium Bonus 🤖

Get on-demand access to two AI-powered bots—exclusive to Premium & Enterprise Members:

Due Diligence Data Room: Upload startup pitch decks, financials, or technical documents and instantly benchmark them against past deals, market comps, and sector trends to accelerate your evaluation process.

Case Study Generator: Input any M&A deal and generate a professional tombstone—complete with transaction details, key players, and strategic rationale—ready for presentations or pitch decks.

Crypto Coin Explorer: Enter any cryptocurrency name or ticker (e.g., “BTC” for Bitcoin) to receive a clear, up-to-date snapshot of its fundamentals, price history, on-chain metrics, and market sentiment.

(Check the end of the article for access.)

Table of Contents

4.4 Pre-investment screening and due diligence criteria

4.5 Pre-investment screening and due diligence differences for blockchain start-ups

5 Conclusion

5.1 Conclusion

5.2 Limitations

5.3 Further research

4.4 Pre-investment screening and due diligence criteria

The third sub-question in this research aimed to provide insights into which investment screening and due diligence criteria VCs use to evaluate start-up ventures and the team.

The majority of the investors indicated that they do not have a standardised criteria that they apply to each venture. This result may be explained by the fact that each business proposition is different. Especially for early-stage businesses, there is limited information on the business including less on metrics, traction, and historical data.

All of the interviewed VCs indicated that the entrepreneur and the team are the most important investment criteria.

"Well first of all, we have to be convinced that these are people we want to work with, and that we want to back. It's absolutely essential that we believe that they have integrity, good judgement, that they will listen to us."VC1

"We are really assessing two things: Is this the person we want to get behind? and Is this a problem we want to get behind? There is no standardised process… Above all, is the people for us, closely followed by the problem in a market that resonates with us."VC4

"We really run everything in a very similar manner, almost regardless from investment stage, we start from the team. Is that the right team? Is that a fit for purpose team? In case of digital assets, that is especially very interesting because it is a new and emerging space. We look at who has experience, who has demonstrated track record in this space?"VC3

"In the world of blockchain, the most important for me is that the team understand where they are going. That would seem fairly straightforward for other sectors, but in blockchain is really complex to know where you are going because the sector is moving fast."VC2

Although, these results differ from some published studies (Looser and Schläpfer, 2001), they are consistent with those of Gompers et al. (2017) and Franke et al. (2008) who found that the entrepreneurs and the team are the most important criteria ranked by VCs.

In terms of assessing the entrepreneurs, some of the interviewees remarked that this is the most difficult part of their job. "You make your judgement, and you do that from spending time talking to the team, to the founder of the team. We take references, we are definitely going to talk to other people. We do what we can; it is not particularly scientific. It is much more of an art than a science."VC1

"I want to see entrepreneurs who see the big picture and have a good idea, where the market is going. Every day, you are going to find companies that are following a trend. That doesn't mean they are not good investment opportunities. But in the world of blockchain, you need them to see beyond that. Okay, you follow your trend, we understand, but do you understand where this trend is going to go to. Do you understand the next trend after that? Do you see it? Do you have a feeling for it? That is what I want to see in the entrepreneurs."VC2

"If you look at the track record of very large funds, and you look at the relationship between the investor and the entrepreneurs. The large successes that you see today, a lot of those are built on really transparent, honest, natural entrepreneur people that just tell you how it is."VC2

"It is really just understanding: is this someone who when the going gets tough, it is gonna keep going. To have that unrelenting passion to keep ploughing on, because it always gets tough, no matter how good your business is."VC4

Some of the very common indices of the quality of people that VCs pay a lot of attention to includes whether somebody is taking a very low salary to get the start-up going. In this instance it is clear that the entrepreneur's commitment is to build the equity value. Another index is whether they have been good at recruiting, and also the overall quality of the angels they have attracted. This suggests respectively that they have very talented partners into the management team and the quality of the people who have gotten involved up until now is what really matters.

All of the investors indicated that they would like to know the history behind the business proposition. Besides the entrepreneurs and the team, other very critical criteria that were mentioned by the interviewee were the quality of the business plan, the go-to-market (GTM) strategy and knowledge of the market size or potential market that the venture is going after.

"Market size or potential market size sometimes are hard to define, but no VC would say that they will invest in small markets or smaller opportunities."VC3

Another mentioned criteria that VCs look into are competition, understanding what can be a lasting competitive advantage, and portfolio fit. "If we have invested in something similar, it is very unlikely that we will invest in a similar opportunity."VC3

A certain negative sign is if the business plan is coming to the VC firm through a corporate finance agent. "That is definitely negative for the whole venture capital industry by the way, but people don't seem to understand. If you have to hire an agent to raise the money, that is a sign that nobody is that interested."VC1

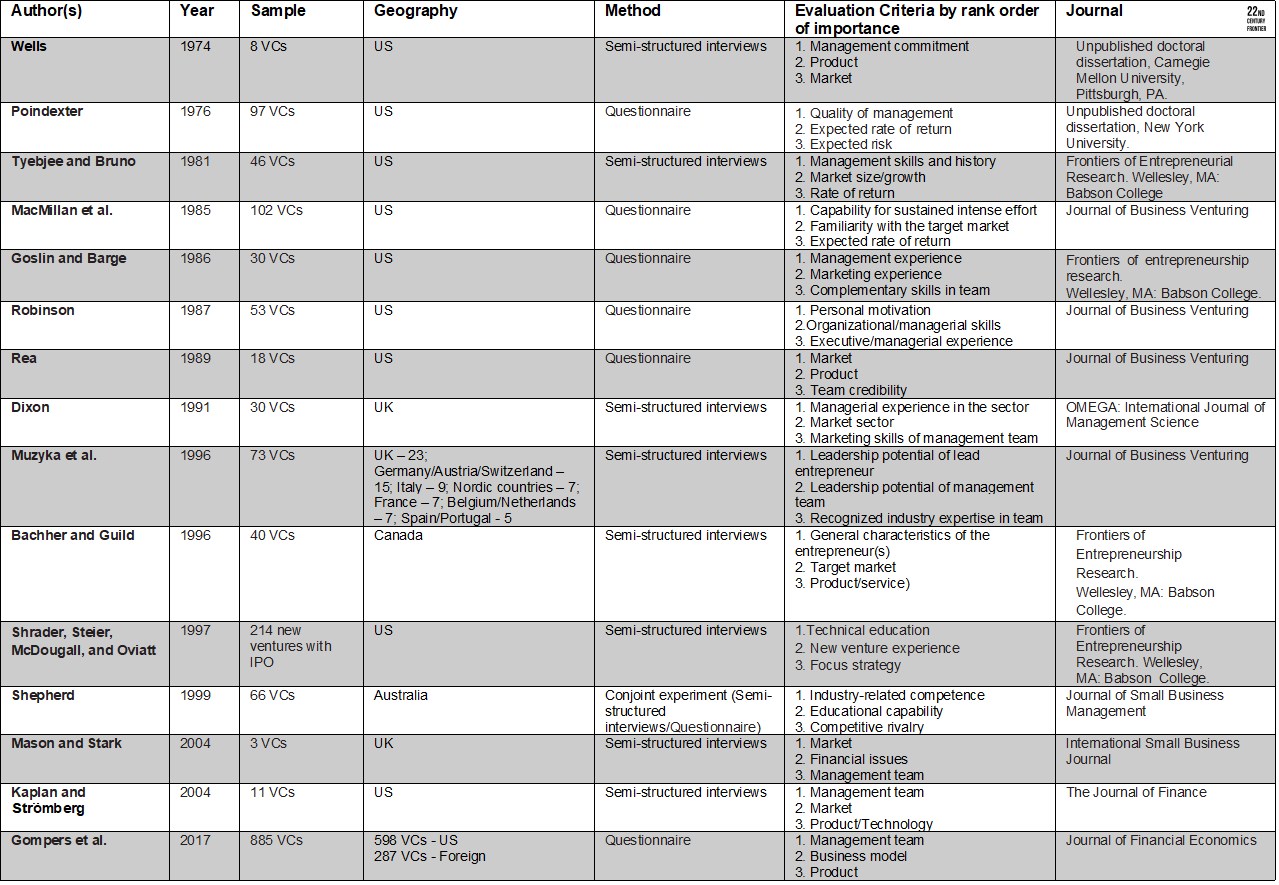

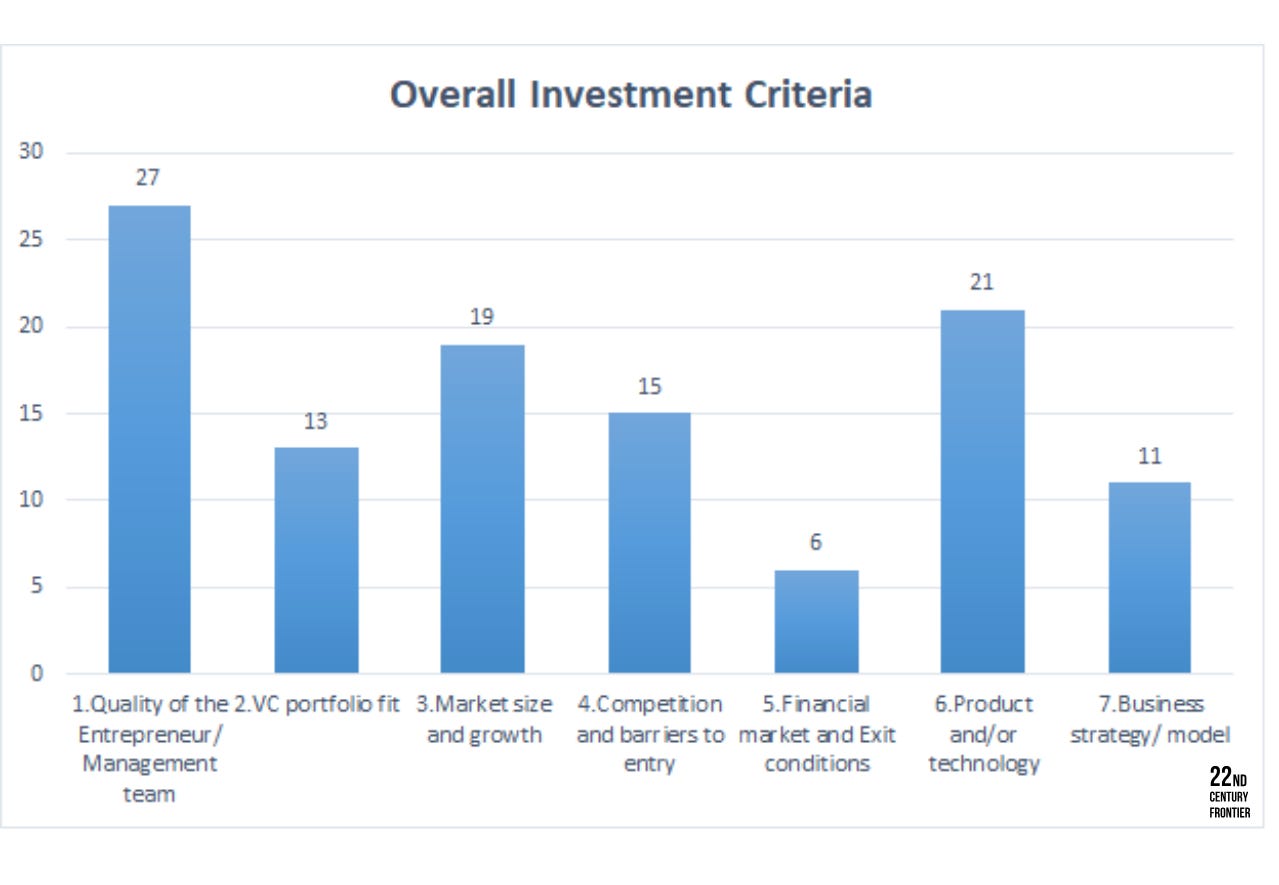

The total number of 58 investment criteria from previous academic studies were identified (Table 2‑1) and grouped into 7 groups (see Table 4‑1). Table 4‑1 was shown to the interviewed VCs and they were requested to rank the different criteria groups, with "7" signifying the highest priority criteria and "1" the least priority one.

Figure 4‑5 Illustrates the criteria ranked by each of the participating VCs. The individual VCs results in detail are found in Appendix A.

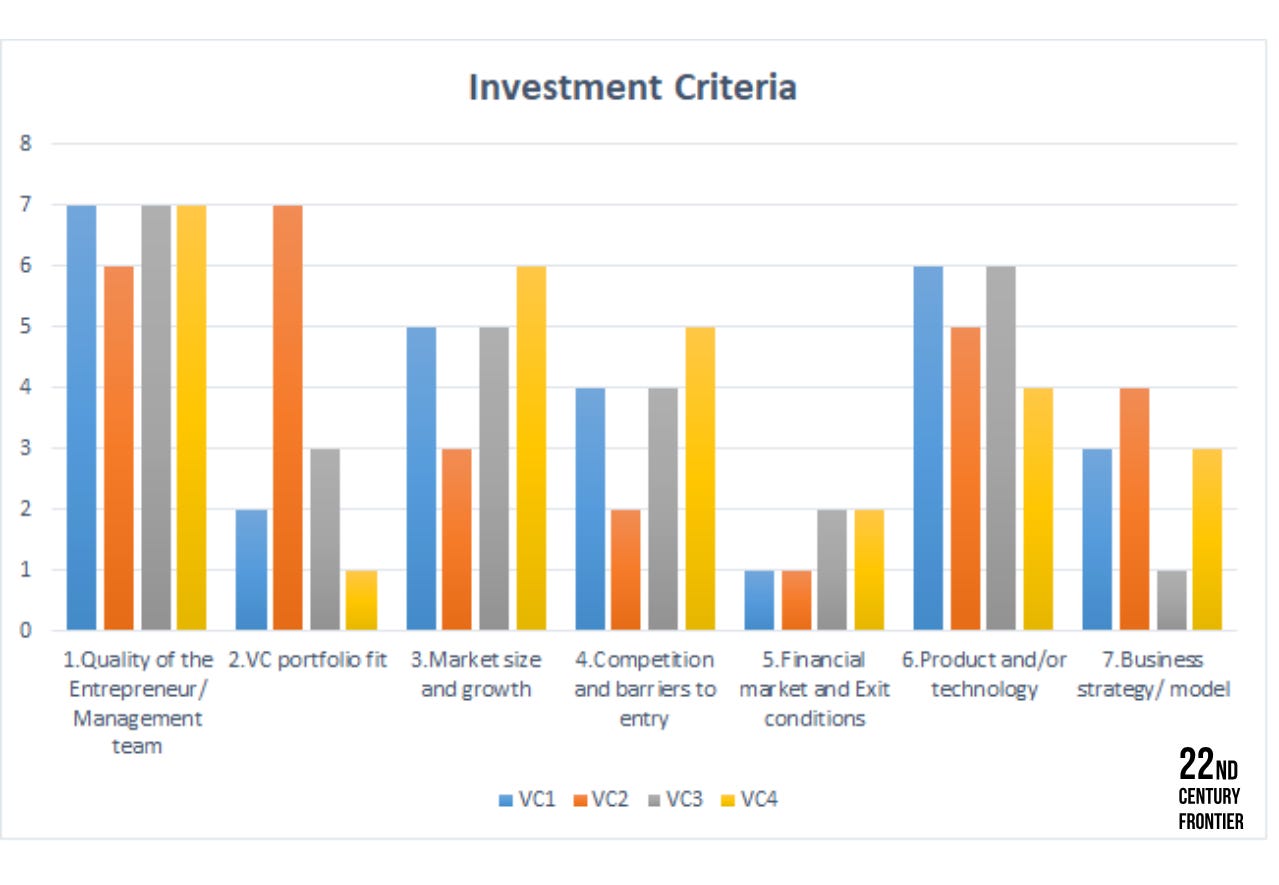

Figure 4‑6 Illustrates the overall criteria result after combining the participating VCs results.

All VCs consider the quality of the entrepreneur and management team as crucial when determining whether to invest in a blockchain technology start-up in its early stages. According to studies on the characteristics of VCs in the United States, VCs invest predominantly in the capabilities of the entrepreneurial team. In fact, it is the entrepreneurial team that will finally convert the business opportunity into reality, especially in the early years of a start-up. VCs rank the characteristics of the venture offering (product and/or technology). This is followed by characteristics of the venture's target market (market size and growth). As several VCs mentioned, it might be difficult to analyse the market being targeted by a blockchain start-up at this point. As a result, their primary attention is on the venture offering, because the company's future success in capturing a market is dependent on the successful development of the product or service. The remaining group of criteria are ranked as follows 4. Competition and barriers to entry, 5. VC portfolio fit, 6. Business strategy/ model and 7. Financial market and exit conditions.

4.5 Pre-investment screening and due diligence differences for blockchain start-ups

The fourth sub-question this research sought to determine is the difference in investment screening and due diligence for blockchain start-ups compared to investing in 'traditional' start-ups.

"There are differences for the first few deals. We really spent a lot of time understanding the technology, understanding blockchain, getting an expertise to help us with our first investment in blockchain."VC1

"In terms of the investment process into the blockchain space, we treat that as very similar to any other enterprise software areas."VC3

The main difference that was mentioned during the interviews was the financial due diligence. "The biggest difference that I have seen is the financial side. It is very difficult to apply certain models to blockchain companies. For example, one of the models that a lot of companies were trying to apply in the early days, let's say 2013-14, was the discounted cash flow (DCF) model."VC2

This result may be explained by the fact that cryptocurrency prices are highly volatile and there is high uncertainty where the prices of the crypto are going to be next year, or even next month. For that reason, it is extremely difficult to use a DCF model based on revenues in cryptocurrencies.

Another important finding was the regulatory side. "The regulatory side was another big difference because nothing was stated, and therefore, you have no idea if what you are doing is legal, illegal, tolerated or not tolerated. Which box is going to fall in. That was always an issue and is still an issue today."VC2

This result may be explained by the fact that many countries are different in terms of jurisdictions and laws for crypto.

"The rest is always the same, you have a kind of known-unknown market, unknown product, market that moves fast, and there is quite a high level of uncertainty. That level of uncertainty today is starting to be lower because today people know that there is a market for crypto."VC2

Some of the important technical factors that VCs also need to consider before investing in tokens are to understand how the incentive structure is built and to understand how much contribution is going to be needed to the protocol.

"The differences are less when you diligence the business, but once you become an actual investor, it changes dramatically how do you engage in that business."VC4

But what was fascinating it was not covered by the literature, as it was part of the post-investment process.

VC4 indicated that there are many differences when a VC firm becomes an investor in tokens from a network. "You become a stakeholder in that network, and you have almost an obligation to help improve the network. They do not want people who own 25% of network without adding to the community."VC4

Some participants shared that there are dramatic differences in the way they engage in blockchain protocol ventures. In traditional businesses, VCs become equity investors by buying shares from a start-up and must regularly participate in board meetings, whereas in blockchain ventures, VCs buy shares in the protocol, and there are no board meetings in these types of businesses.

"I have quarterly board meetings with businesses I have invested into. I come, and we make decisions there. Is not how it works when you invest in protocol, crypto businesses or blockchain businesses because decisions are made all the time and there is a voting structure."VC4

Up to the point of signing the shareholders’ agreement, the structure is very similar to that of traditional start-ups, but the post-investment interaction differs significantly from non-blockchain start-ups due to the nature of the technology, as blockchain fundamentally shapes the relationship between investor and start-up.

5 Conclusion

This chapter presents the main conclusions. It also describes the limitations of the research and the prospects for further research following this study.

5.1 Conclusion

The intention of this research was to identify the UK start-up and VC investors landscape and to contribute to the entrepreneurship literature by providing a clear set of insights on how VCs make investment decisions in the blockchain industry.

The method employed comprised secondary data research in order to identify the landscape, followed by semi-structured interviews with 4 VCs and analysis of the results and comparison with the existing literature.

This research yielded four major results. To begin, 517 fundraising deals by 220 UK blockchain start-ups for the time period of December 2009 until August 2021 were identified. The total amount of fundraising equals to £1,1b. Among all the investors, 33 VC firms were identified. They have invested into 48 ventures. The study showed that the most active sectors that blockchain start-ups are involved are Crypto Trading, R&D Blockchain Services, FinTech and Security.

Second, different deal flow sourcing styles that VCs use to find good investment opportunities were identified, such as: networking, research-based, business problem and solution. The structure of typical pre-investment process and overview of what exactly is happening within each stage of the process.

Third, this study indicates that the entrepreneur and management team are the most important factors that VCs look for in a proposed investment. Product and/ or technology is ranked second, followed by 3. Market size and growth, 4. Competition and barriers to entry, 5. VC portfolio fit, 6. Business strategy/ model and 7. Financial market and exit conditions.

Lastly, the main difference in investment screening and due diligence for blockchain start-ups and traditional ones, were identified during the first few blockchain deals where the VC fund needs to understand the technology behind the proposition. Other differences were identified in the financial side, by using certain financial models such as discounted cash flow, and in the regulatory side, by countries' different laws and jurisdictions. Overall, up to the point of signing the shareholders agreement, the structure in blockchain technology deals is very similar to the traditional start-ups, but the post-investment interaction differs heavily from the non-blockchain start-ups due to the nature of the technology. Blockchain has an impact on the interaction between investor and start-up.

The study provides an academic contribution in two aspects. First, the findings contribute to the blockchain literature by mapping the landscape of UK blockchain start-ups and VC investors up to August 2021, and by providing insights into the nature of investment in blockchain technologies, as well as the differences in pre-investment screening and due diligence between blockchain and traditional start-up ventures.

Second, the findings contribute to the entrepreneurship literature by determining the nature and relevance of deal sourcing and deal selection. Venture capitalists commit considerable resources to them. The results are consistent with Gompers et al. (2017) and Franke et al. (2008), and present new findings that provide deal sourcing and deal selection differences in regard of blockchain technology ventures.

Finally, these findings might be useful for practitioners, particularly blockchain start-ups looking to raise funds from venture capitalists. Entrepreneurs could use the findings to understand how they will be evaluated. The research includes a detailed list of factors that VCs believe are significant in screening and evaluating prospects. As a result, the list is useful for entrepreneurs to utilise as part of their initial evaluation of an opportunity.

5.2 Limitations

The response rate of roughly 10.8 %, is similar to that obtained by Graham and Harvey (2001), at 8.9 % for chief executive officers, and 13.8 % response rate for private equity LPs obtained by Da Rin and Phalippou (2014).

As a remark to researchers, the author would like to emphasise that this type of study is extremely challenging in the European environment (Muzyka, Birley and Leleux, 1996). In contrast to the US, where there is a rather widely established culture of information exchange, no such culture exists in European nations. Privacy regulations in Europe vary by country, although they are generally established.

5.3 Further research

Four areas of avenues of further research have been identified. Firstly, blockchain is becoming a layer across many industries. As we have seen blockchain is moving into other industry sectors. It would be fascinating to explore which sectors are going to be rapidly changing and adopting it.

Secondly, this study indicates that VCs pay the greatest attention to the quality of the entrepreneur and management team. Further research into the qualities of the most successful entrepreneurs in the blockchain space could be a promising avenue of study. The existing UK blockchain start-ups and VC investors landscape (Figure 4-2) could be useful for identifying blockchain start-ups to contact for this purpose.

Thirdly, the results of this research also indicated that it is very difficult to apply traditional VC financial models to blockchain companies due to the volatility of their cryptocurrency. Potential field for further research is the review of valuation models that can be applied to blockchain businesses.

Lastly, the research indicates that post-investment interaction differs significantly from that of non-blockchain start-ups due to the nature of the technology. Blockchain influences the interaction between the investor and the start-up, making post-investment communication a potentially fertile and interesting area for further research.

🔑 Unlock AI‑Powered Insights (Premium & Enterprise Members Only)

📂 Due Diligence Data Room

Accelerate your investment evaluations by uploading startup documents and instantly comparing them to past deals and market trends. For example:

Explore industry benchmarks for SaaS company growth rates

Recommend follow-up questions for startup founders

Analyze revenue projections against market benchmarks

Summarize competitive advantages cited by the startup

Fact-check historical growth rates cited by the founder

Tech me best practices for data room organization

Compare team backgrounds with previous investment successes

Write an investment rationale highlighting pros and cons

and more!

📜 Case Study Generator

Simply input any M&A deal and produce a professional tombstone. For example:

Explore trends in cross-border M&A activity

Recommend sources for M&A deal data

Break down deal structure in recent M&A transactions

Summarize key facts from a recent M&A deal

Fact-check reported deal values in M&A news

Teach me how to analyze M&A case studies

Contrast hostile vs friendly takeovers

Create a tombstone for a recent M&A deal

and more!

🪙 Crypto Coin Explorer

Enter any cryptocurrency ticker or name for a comprehensive, up-to-date overview. For example:

Explore recent news and updates about this cryptocurrency

Recommend exchanges with the best liquidity for this coin

Analyze recent price trends for this coin

Summarize recent community sentiment around this coin

Confirm if this coin is listed on major exchanges

Teach me how this coin’s consensus mechanism works

Compare this coin to Bitcoin and Ethereum

Draft a summary of this coin’s roadmap

and more!

Remember: you can take a 7-day free trial.

Get Access to Your Premium Bots Below 🤖👇

Keep reading with a 7-day free trial

Subscribe to 22nd Century Frontier® to keep reading this post and get 7 days of free access to the full post archives.