🚀 Inside the Minds of VCs: How UK Funds Evaluate Startups (Part II of IV)

Part II of IV — A Deep Dive into Pre-Investment Decision-Making in Frontier Tech

Welcome to 22nd Century Frontier — your strategic edge in innovation, investment, and entrepreneurship. ⚡

"Audentes Fortuna Iuvat"

~ Latin Proverb

In Part I, we laid the intellectual foundations of UK venture capital—from its wartime origins to the unique role VCs play in frontier innovation—and showed how this multi‑month research was conducted in the field, not from a desk. Now, we’re pulling back the curtain on the precise decision‑making frameworks used by those same senior executives at four leading UK VC firms to navigate the high‑stakes world of frontier‑tech investing. This series isn’t theory—it’s built on five months of fieldwork, 517 real funding rounds, and candid interviews you won’t find anywhere else.

What You’ll Discover in This Series:

Part I: Laying the Foundations

Setting the Stage: A historical primer on UK PE/VC evolution, the mystery we set out to solve, our four guiding research questions, the three‑stage field‑based methodology, and how each part of this series builds your ultimate VC playbook.

Part II: Decoding the VC Screening Playbook

Venture Capital 101: We’ll start with a crisp primer on what defines venture capital—why VCs back pre‑revenue, high‑risk ventures and how they consistently outperform public markets over 5‑ and 10‑year horizons.

End‑to‑End VC Process: A step‑by‑step walkthrough of the generic VC investment lifecycle—from deal sourcing and pre‑investment screening to term‑sheet negotiation and eventual exit.

Deep Dive into Deal Screening: Unpack the seven core screening pillars—VC portfolio fit, entrepreneur/team quality, market size & growth, competition & barriers, product/technology, business model, and exit potential—and learn how VCs triage hundreds of pitches down to the select few they back.

Data‑Driven Rankings: See how academic surveys of 885 institutional VCs align (or conflict) on the relative weight of each criterion, with management team quality, business model viability, and market dynamics consistently topping the list.

Real Quotes, Real Context: Hear verbatim insights from our four UK fund partners on their red‑flag deal killers and green‑light hallmarks—straight from the front lines of frontier‑tech investing.

Part III: Unveiling the Findings & Discussion

Navigate the UK VC Playbook: We’ll chart the UK frontier‑tech ecosystem, uncover the five proprietary deal‑sourcing strategies VCs use, guide you step-by-step through their pre‑investment process and seven core screening pillars, and reveal the unique twists in evaluating blockchain ventures versus traditional startups.

Part IV: Mastering VC’s Art vs. Science

Unveil VC’s Ultimate Playbook: Uncover why VCs place founder & team quality above all else, how they rank and apply seven core screening pillars into a rigorous due‑diligence engine, the extra hurdles they set beyond the pitch deck, the unique curveballs of blockchain diligence, and how their role pivots post‑investment into network stewards rather than traditional board members.

This series isn’t just a look behind the curtain — it’s a step into the war room of modern VC decision-making.

Let’s dive into Part II. 🧠💼

Premium Bonus 🤖

Get on-demand access to two AI-powered bots—exclusive to Premium & Enterprise Members:

Profile Builder: Enter any person or company name for a clear, comprehensive background profile.

Due Diligence Check: Input any company name to receive a detailed public-info due-diligence report.

(Check the end of the article for access.)

Table of Contents

2.3 Venture Capital

2.3.1 The Venture Capital Process

2.3.2 Pre-investment deal screening

3 Methodology

3.1 Research Methods

3.2 Samples

3.3 Research design

2.3 Venture Capital

Venture capital is a type of investment in early-stage or start-up businesses that have a high potential for development. VC funds often invest in young, pre-profit, and even pre-revenue firms. These are mostly technology or science-driven firms with an innovative or disruptive business model or product. VC firms purchase minority equity shares in these companies and support them with financial assistance and business acumen to help them expand and thrive. As noted by Barrot (2016), VC assists entrepreneurs in identifying and developing their business strategy in order to bring their product to market, fulfill a business or consumer need, and create real value. Since the firms are still in their infancy, VC investors will take a methodical and comprehensive approach to assessing not only the viability of the business idea, but also the entrepreneur's drive and background. (Hochberg, Ljungqvist and Lu, 2009). VC seek out great ideas and even greater entrepreneurs who have a strong drive and determination to carry their vision through to success.

This approach has been proved to be successful for over two-decades, and research have shown that venture capital firms outperform the public corporations Financial Time Stock Exchange Group (FTSE) All-Share Index in the five-year and ten-year annual returns by 12.6% and 6.1% respectively (British Private Equity and Venture Capital Association, 2019, p. 4).

2.3.1 The Venture Capital Process

Gompers et al. (2017) noted that since 2001, a considerable number of empirical studies have been devoted to investigate VC decisions and actions. Nonetheless, these studies have left gaps in people's understanding of what venture capitalists really do.

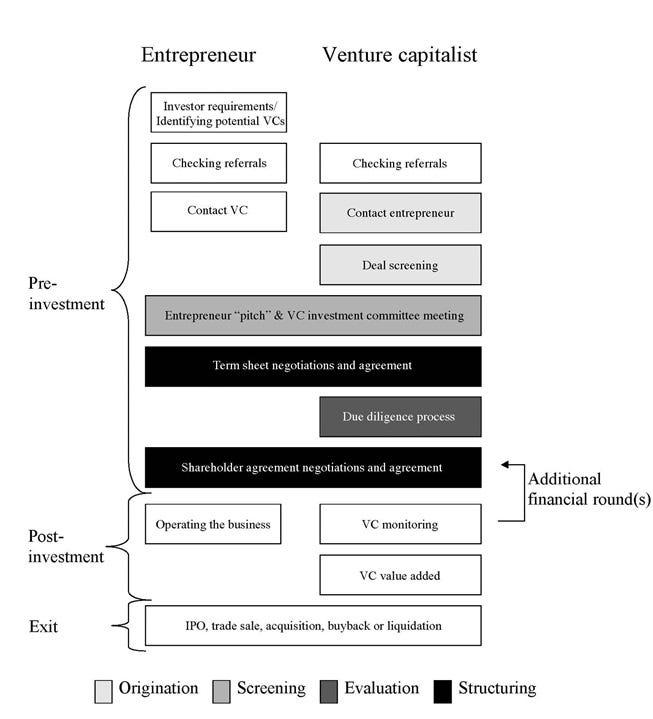

As noted by Gorman and Sahlman (1989), when a VC fund plans to invest in a firm, a process is developed and followed until the firm is exited at a later stage. Clercq, Fried, Lehtonen and Sapienza (2006) bring a generic vision of the analytical process, see Figure 2‑2. After conducting deal sourcing, the VC fund starts the pre-investment process. Throughout this stage, the VC firm examines, evaluates, assesses the risk and determines the deal's funding structure.

As this study focuses on the evaluation and assessment process, the pre-investment deal screening stage shall be discussed in further detail.

2.3.2 Pre-investment deal screening

As start-up investments – especially in the early stages – carry great uncertainty, investors need to find ways to mitigate risk. The sourcing of the best deals and their proper evaluation is cruicial to the success of a VC fund. Since the early-stage investors are providing funds to companies with little or no track record, i.e., without much reliable performance data, the investment decision has to consider numerous 'subjective factors'.

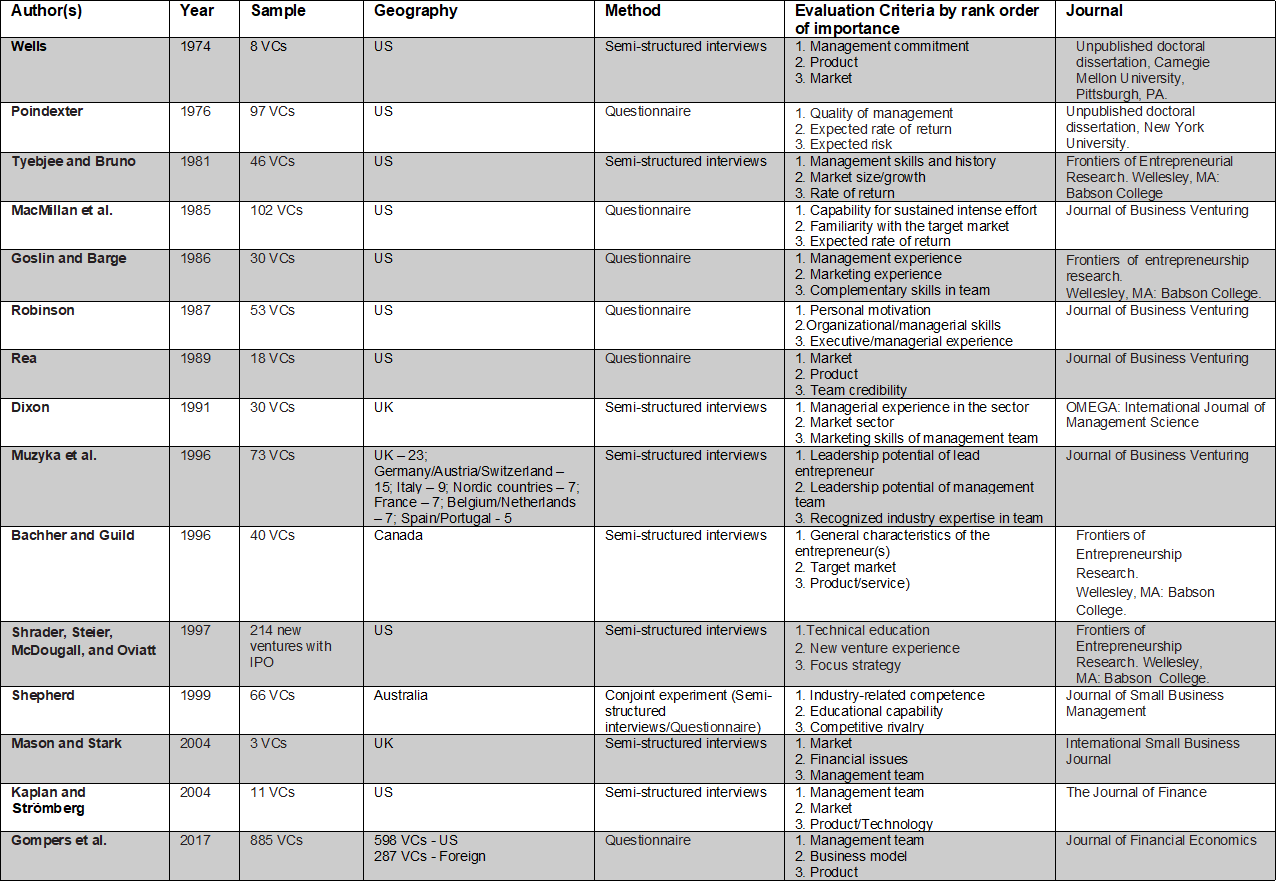

Academics and practitioners debate about which screening and selection factors are the most essential. Kaplan and Strömberg (2004) outline and analyse how VCs choose investment opportunities. They confirm prior studies that venture capitalists assess aspects such as market attractiveness, business strategy, technology, product or service, customer adoption, deal terms and the management team's quality and experience. They, however, make no distinction between the relative importance of the various aspects. Previous research by Gompers, Kovner, Lerner and Scharfstein (2010) demonstrate that past success as entrepreneur is an important factor VC funds consider when attracting potential investments. However, few academics have been able to draw on any systematic research into the pre-investment deal screening criteria for VCs. In empirical research completed by Gompers et al. (2017) 885 institutional venture capitalists (mainly from the US) who invest within the Information Technology (IT) and Healthcare sectors were surveyed and asked how they make decisions about their investments and portfolios. The research reveals that regarding their selecting investments criteria, VCs place the most significant importance on the management/funding team (95%), followed by the business model (83%), product (74%), market (68%) and industry (31%). 'Fitting' with the fund and the capacity to add value were rated lower on the ranking. Early-stage investors and IT investors place a greater emphasis on the team. In contrast, according to Looser and Schläpfer (2001), the most important VC criteria is the market – its growth, size, degree of competition, customer benefits, and problem solved by the venture. Zopounidis (1994) concludes that there is "great diversity of evaluation criteria and their relative importance from one study to another..." although "the criterion of the management team is considered predominant..."(p.63).

Table 2‑1 provides a summary of the most observed criteria by researchers. All of the shown criteria can be applied to all investment proposals that are submitted and fall under the scope (overall fit) of the VC fund's investment strategy.

VC Portfolio Fit

As noted by Alemany and Andreoli (2018), given that there is an abundance of investment opportunities and that only a small number of start-ups will eventually be funded, an executive summary should be used to validate the general fit of the investment proposal with the investment VC fund strategy. The VC applying this criterion as part of its investment strategy will first of all eliminate all start-ups focusing on topics other than their target one from their screening process.

Management/Funding Team

Most private and institutional investors agree that the team is the most essential component of venture screening, as well as one of the most difficult to evaluate (Franke et al. 2008). A collective mindset in the VC industry is that one is better off investing in a good team with a mediocre idea than investing in an average team with an outstanding idea (Bygrave, 1997). The information might come from CVs, professional (social) networks and a review of certificates or references in media articles, to assess the operational (start-up) and industry experience of the team (and board) members. Researchers found that VCs are more likely to fund individuals who have a comparable background to their own (Franke et al. 2006).

Product/Service Offering

As noted by Tyebjee and Bruno (1984), understanding the functionalities of the product and its relevance to the problem that is solved for customers is vital. Other criteria used to assess the attractiveness of a new venture's offering include customers' readiness to pay for the product, the unique selling proposition (USP), the product's potential for intellectual property (IP) protection, the unit economics, scalability, possible ways to vary or diversify the product and the make-or-buy (value chain) approach that the start-up plans to take.

Market/Industry and Competitors

The growth rate of the market addressed by a start-up is an important indicator of the potential of the firm (AF Bureau, 2020). The competitive landscape in the market targeted by the start-up will be of interest to investors, not only regarding the company's potential conflict with competitors but also with regard to understanding how likely it is that one of its competitors may eventually acquire the start-up. The VC fund needs to find as much data on the market and competition as possible through looking at the present and future geographical scope of the company, the targeted industry segments and the direct and indirect competitors serving the same market. For a better understanding of the industry attractiveness, Alemany and Andreoli (2018) note that VC funds apply frameworks such as PESTEL analysis and Porter's Five Forces.

Business and Sales Model

According to Zider (1998), many experienced investors in the VC industry claim that, apart from the team, the business model is the second most important aspect of the screening process. The team's ability to understand its customers and implement a business model that fits the market need is a fundamental element of the team's entrepreneurial talent and the potential of the company to excel. Using this criteria, VCs try to understand the company's marketing mix 5 Ps (place, promotion, price, product and people) as well as the fit between the business model and its customers' expectations or behaviours. Analysis of the business model is a cross-check against the review of the product and the financials.

Financials

Alemany and Andreoli (2018) claim that experienced investors will only look at three to five-year budgets to get a general sense of the expectations of the start-up and its team. They will focus more on the business metrics that the entrepreneurs used to design the budget. VCs will try to get deeper understanding of the founders' assumptions regarding the customer lifetime value (CLV), customer acquisition cost (CAC), demand price sensitivity, churn rates and other unit economics. The VC will also cross-check the financial with the investment case to see how future liquidity plans are reflected in the timing and volume of future rounds of funding, i.e. the financial strategy of the start-up.

Investment Case and Exit conditions

For the VC, the screening of the investment case is often as important as the screening of the executive summary, because one possible result could be that the deal does not yet meet (too early-stage) or no longer meets (too late-stage) the investor's strategic requirements. The VC tries to get an in-depth understanding of the venture's previous funding activity, past and current valuations, liquidity, shareholder structure, planned execution of the current round of financing, ticket sizes, existing investors commitments and the background of current investors. The VC will also make efforts to grasp the potential future development of the business (e.g. how many more rounds of funding at what valuation levels will there be, what will the road to exit be, and what is the time horizon of the investment).

Roadmap

The VCs undertake screening of the roadmap to learn what the company plans to do in the next 12 months (or five years) to reach an exit at some point in the future. The VC will assess the entrepreneur's growth plan regarding the team, product, geographic and industry segment expansion, and the adoption of new business models, as well as the timing and volume of future rounds of funding. The VC is also likely to spend some time trying to figure out what their screening results (regarding the team, product, market and competition, business model and investment case) will look like in the next 12, 24, 36 or 48 months.

Pre-investment screening seeks to strengthen and add credibility to the due diligence (DD) process, offering a solid basis for VCs to undertake their analysis.

Investment criteria and selection factors such as VC portfolio fit, Management and Funding team, Product/Service offering, Market/Industry and Competitors, Business and Sales model, Financials, and Investment Case and Exit conditions, appear to be some of the most discussed within the literature in terms of investment criteria and factors that VCs devote a considerable amount of time and resources to look into when assessing a potential investment opportunity.

3 Methodology

This chapter aims to describe the methodology behind the research and justify why this method was selected and comparing with other alternatives.

3.1 Research Methods

Previous studies on VC investment criteria, which have primarily used standard Likert scaled survey techniques, have yielded relatively broad results indicating that the "human factor" is crucial. Furthermore, the majority of this research has been conducted with VCs headquartered in the United States. Furthermore, the research has been largely exploratory, assuming a single hierarchy of decision factors throughout all scenarios and among all VCs. This study builds on previous research by investigating the investment criteria used by VCs who invest in blockchain ventures in the UK.

European VCs are weary of questionnaires addressed to them from the US (Muzyka, Birley and Leleux, 1996), and of surveys recently performed by different European organisations, including their own organisation, Invest Europe, previously known as the European Private Equity and Venture Capital Association (EVCA). This sense of discontent, particularly among less-informed academics, has lately been heightened by industry worries about VC return and investment exit obstacles.

Being conscious of the VC industry's unfavourable approach regarding surveys (Muzyka, Birley and Leleux, 1996) and having in mind the research objectives stated in the first chapter, it was decided to set aside a considerable amount of time for semi-structured interviews. The approach has been previously effectively applied to investigate the decision-making process of VCs (Bachher and Guild, 1996; Mason and Stark, 2004) and has also been used in various other contexts (see Scarlata and Alemany, 2010). The recommendation by Muzyka, Birley and Leleux (1996) which states that in the European environment, it is important to be well prepared when contacting VC investors and meeting with them in person, since this demonstrates the seriousness of the effort was applied. Respondents' verbalisations are recorded, transcribed, and then content analysed using a coding scheme tailored to the specific study sub-questions.

3.2 Samples

In spite of the fact that there are no public registries or archives of all VC funds' investment activity for companies within the blockchain sector, companies' details were identified through in-depth analysis of several online secondary data sources.

Using the snowball sampling approach, within eight weeks a database of 33 Venture Capital firms that had invested in blockchain ventures within the period December 2009 to August 2021 was generated. All of the VC firms were located within the United Kingdom. In total, 33 VC firms were contacted. The names of the partners involved into the funded blockchain deals were identified through Crunchbase.com. Then, from the VCs firm websites, the emails or LinkedIn profile of 37 investors who were involved into blockchain deals were identified. The chosen VCs were contacted by email or by LinkedIn for the cases where the email wasn't stated on the firm's website. Of these, 4 investors accepted the request for person-to-person interview (3 via Zoom, 1 in-person). This equates to a response rate of 10.8 %, which is similar to the obtained rate for surveys by Graham and Harvey (2001), 8.9 % for Chief Financial Officers (CFOs), and Da Rin and Phalippou (2014) obtained response rate of 13.8 % for PE limited partners. General agreement to participation in the study was solicited, and a time scheduled for the interview via Zoom or in-person. At the beginning of the interview, the study and its purpose was described.

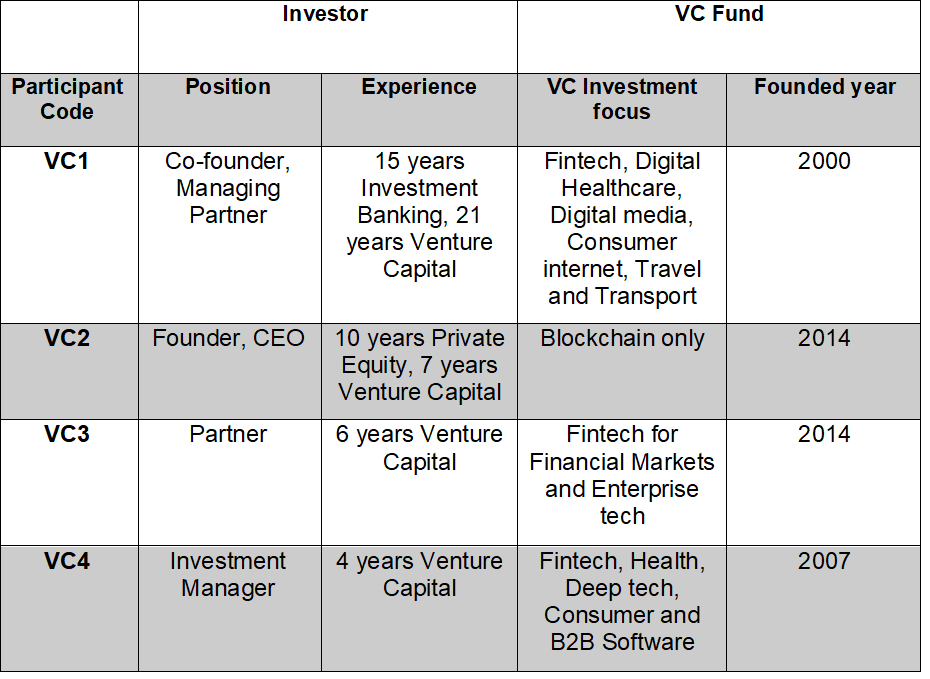

All of the interviewed VCs were senior industry experts, either managing partners, partners, investment managers or chief executive officers (see Table 3‑1). Each of these VC funds' senior executives analyse start-ups seeking early-stage investment using their own decision-making criteria.

VC1 is a co-founder and managing partner in one of the UK's most well-established technology VC firms. The firm typically invests in seed, stage A and scale-ups via the various funds it manages. The fund invests in various sub-sectors within technology, including fintech, digital healthcare, digital media, consumer internet, travel, and transport.

VC2 is a co-founder and chief executive officer (CEO) of one of the pioneer VC funds that invest in blockchain technologies in the UK. Since 2014, they have invested in early-stage, blockchain-only ventures.

VC3 is a partner in a pure finance market technology-focused VC. The firm is a leader and one of the best-connected investors in financial services. They have invested heavily in building one of the strongest ecosystems in the financial markets industry.

VC4 is an investment manager in one of Europe's largest and most active VC investors. The fund invests more than £200 million every year, from seed to series B, across five areas with high growth potential – fintech, health, deep technology (deep tech), business-to-business (B2B) software and consumer.

The intention of this research was to gather information from experts involved in analysing and making real investment decisions.

3.3 Research design

This section explains how semi-structured interviews were used to collect information. Data were accumulated from four VCs in total. Each interview took between 30 and 45 minutes to complete.

The investors began by defining their investment process from when they first identify a start-up, receive investment presentation deck (Pitch Deck) or receive a warm recommendation about a particular start-up, to when they negotiate the shareholder agreement with the venture team and sign it.

Next, the investors were requested to analyse a list of pre-investment criteria that they use to evaluate start-ups in their early phases of growth. After their criteria were defined, the investors were shown a table that identifies 58 decision making criteria (derived from the literature). All of the criteria were classified into seven groups: 1. Quality of the Entrepreneur/Management team; 2. VC portfolio fit; 3. Market size and growth; 4. Competition and barriers to entry; 5. Financial market and exit conditions; 6. Product and/or technology and 7. Business strategy/model; All VCs were asked to discuss and score the seven groups in order of significance to their overall decision making, with "7" representing the most significant category and "1", representing the least essential.

Finally, the VCs were asked to discuss the differences of pre-investment screening and due diligence process for blockchain start-ups in comparison to traditional start-ups.

🔑 Unlock AI‑Powered Insights (Premium & Enterprise Members Only)

🔍 Profile Builder

Instantly generate deep background profiles on any person or company. Just ask, for example:

Investigate the background of a notable executive

Suggest leadership development resources for executives

Break down leadership changes over the past year

Summarize recent news about a company or person

Fact-check reported revenue figures for a company

Explain the basics of corporate governance

Contrast leadership styles of two CEOs

Draft a leadership team overview slide

Recommend top competitors for a given company

Confirm recent funding rounds for a startup

Help me learn about industry benchmark

Compare product offerings between competitors

Create a structured company profile summary

and more!

📊 Due Diligence Check

Produce a complete public‑info DD report on any company. Just ask, for example:

Investigate recent legal issues facing this company

Propose best practices for credit risk assessment

Analyze customer concentration risks for this company

Summarize key operational risks for this company

Confirm accuracy of disclosed environmental liabilities

Help me learn to evaluate management credibility

Contrast credit ratings across industry competitors

Generate a template for credit risk assessment

Research operational risks for a target company

Suggest sources for negative news on a company

Break down management’s crisis track record

Summarize key operational risks for this company

Confirm accuracy of disclosed environmental liabilities

Explain how to interpret credit risk ratings

Company this company’s ESG risks to peers

Draft a summary of negative news for investors

and more!

Remember: you can take a 7-day free trial.

Get Access to Your Premium Bots Below 🤖👇

Keep reading with a 7-day free trial

Subscribe to 22nd Century Frontier® to keep reading this post and get 7 days of free access to the full post archives.