22nd Century Frontier at Angel & Accelerator Virtual Conf 💸, Fusion Startups Race to Scale 🔥, Vibe Coding’s Hidden Risks 🙃 & more!

Weekly Frontier Brief - Week 36, 2025

Welcome to 22nd Century Frontier — your strategic edge in innovation, investment, and entrepreneurship. 🚀

Partner Spotlight: Angel & Accelerator Virtual Conf 2025🚀

We’re excited to share that 22nd Century Frontier is a media partner for the Angel & Accelerator Virtual Conference for investors & startups on September 25th! 🎉

2 tracks for investors and founders, 20+ speakers, 500+ investors.

3.5h Zoom sessions + 1.5h Virtual Networking Zone, and optional 1:1 pitch calls.

Speakers include leaders from Techstars, Plug and Play Ventures, Samsung Ventures America, and many others.

👉 Register for free: https://pitchcalls.com/a?57

We arranged 25% off on optional add-ons: Super Pitching Ticket for startups and Super Networking Ticket for investors and others.

👉 Use code 22NDCENTURYFRONTIER25 at checkout.

Sessions focus on investor decision making and diligence, syndicate vs VC strategy, dependable deal flow using AI and networks, fundraising in 2025 from pre-seed to Series A, and clear messaging that converts meetings, with ROI takeaways for investors and founders.

More speakers and topics: https://pitchcalls.com/a?57

Recent Dispatches 📨

🔹 Founder Growth Sprints🚀, AI Unicorns Claim Top Valuations 🦄, Robots Enter Society 🤖 & more!

🔹🚀 Inside the Minds of VCs: How UK Funds Evaluate Startups (Part IV of IV)

🔹New Chapter: Joining Verb Ventures as Venture Partner

🔹🚀 Inside the Minds of VCs: How UK Funds Evaluate Startups (Part III of IV)

Frontier Flashpoints 🚀

Every Fusion Startup Raising $100M+ Is Betting Big on Limitless Energy 🔋

Advanced AI, powerful superconducting magnets, and better simulations are driving private fusion companies to scale, aiming to upend trillion-dollar energy markets. (Tim De Chant, TechCrunch)

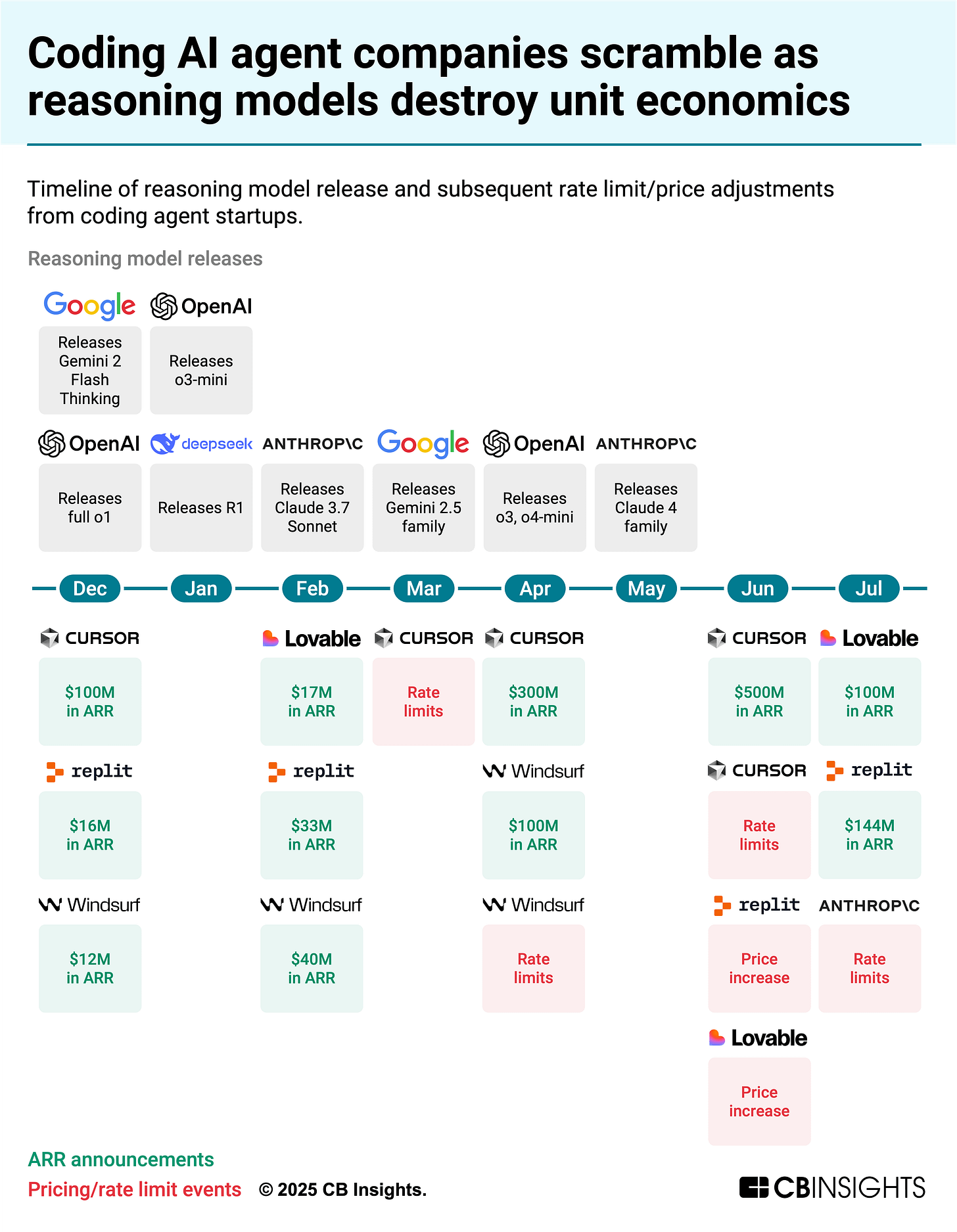

Will “Vibe Coding” Be the Next Unicorn Factory—or the Next Security Meltdown? 🙃

Investors are doubling valuations every few weeks, even as hacks and breaches expose massive risks in the buzziest new category of AI-assisted coding tools. (Michael Bodley, PitchBook)

Hermes 4 Challenges Proprietary AI Dominance ✨

Nous Research’s Hermes 4 matches or exceeds ChatGPT and Claude on reasoning and math benchmarks while giving users unprecedented control. (Michael Nuñez, VentureBeat)

Autonomous Vehicles Are the Future of Logistics 🛣

17% of logistics professionals believe self-driving trucks, ships, and drones will have the most disruptive impact on the industry in the next 2–3 years. (Conor Cawley, Tech.co)

Does Raising More VC Actually Kill Startups? 🤔

Relying on repeated fundraising can push founders into unprofitable growth, while durable slow-growth models may secure survival. (Julie Bort, TechCrunch)

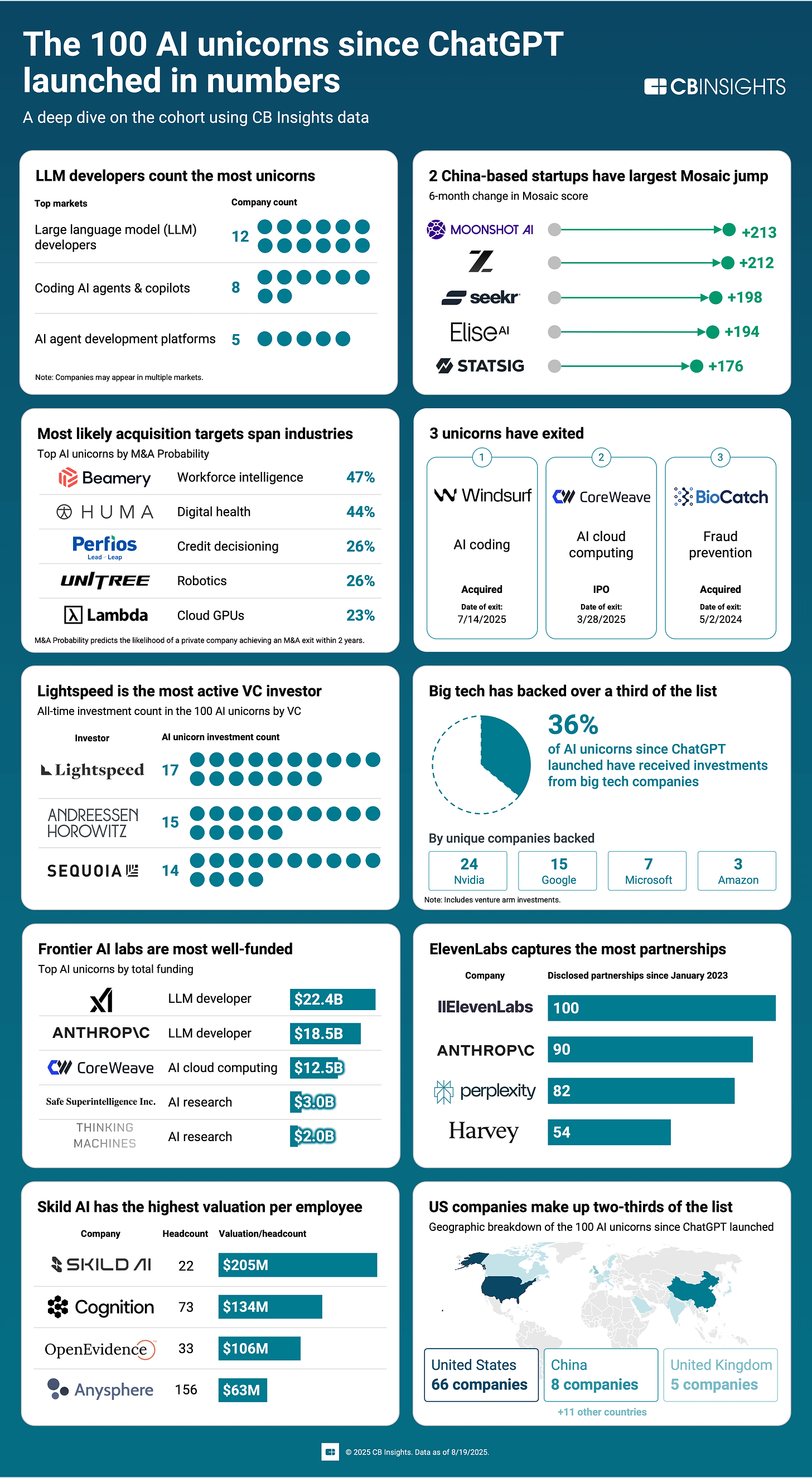

The Next Unicorn Might Not Hire Anyone 🦄

Ultra-lean, AI-native startups are scaling revenue and valuations with minimal headcount, challenging the traditional notion that growth requires large teams. (Megan Carnegie, TNW)

🎯 Want to reach 25K+ entrepreneurs, investors, and corporate executives?

For sponsorship opportunities in this newsletter and across our other media channels, email: 22ndcenturyfrontier@euphoriatechgroup.com

Data Deep Dives 📈

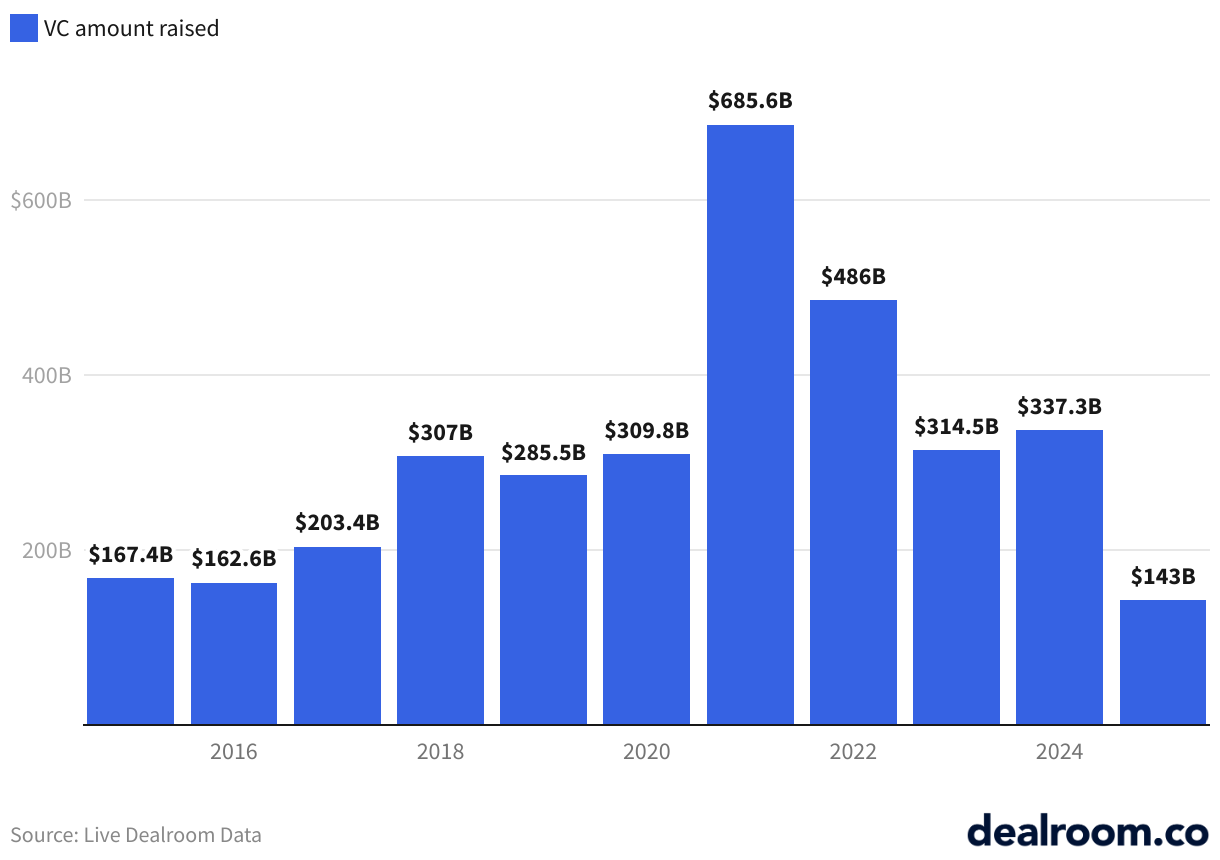

Global VC Investment Hits $337B in 2024 📈

Tech companies attracted one of the highest annual investment totals on record, signaling sustained confidence in innovation and growth. (dealroom.co)

100 AI Unicorns Have Emerged Since ChatGPT’s Launch 🦄

Generative AI’s explosion since November 2022 has led to more AI unicorns than non-AI unicorns, reshaping the innovation landscape. (CB Insights)

Reasoning Token Shock Forces New Pricing Models🤖

As reasoning models increase output-token volumes up to 20x, compute costs surge, pushing vendors to adopt usage-based or open-model pricing to maintain margins. (CB Insights)

The no-hire unicorn trend is fascinating. It completely inverts the old VC playbook of 'we're investing in your team's ability to scale.' Now the bet is on a founder's ability to automate scaling. Changes everything about what a strong team even looks like at the seed stage.

Thanks for putting this together!

Thanks for the weekly round up - always jam packed 🌟