🚀 Inside the Minds of VCs: How UK Funds Evaluate Startups (Part III of IV)

Part III of IV — A Deep Dive into Pre-Investment Decision-Making in Frontier Tech

Welcome to 22nd Century Frontier — your strategic edge in innovation, investment, and entrepreneurship. ⚡

"Audentes Fortuna Iuvat"

~ Latin Proverb

In the last issue of this series (Part II), we pulled back the curtain on VC screening—revealing the seven core filters that sift pre-revenue pitches and the data-driven rankings and candid anecdotes behind every go/no-go decision.

Now, in Part III, we’re charting the UK frontier-tech ecosystem: mapping 517 funding rounds by 220 startups across crypto trading, FinTech, R&D services, security, IoT, AI, and GovTech; uncovering the five proprietary deal-sourcing strategies VCs deploy; and guiding you step-by-step through the pre-investment journey—from first Zoom call to multi-hour site visits and the Investment Committee’s final term-sheet verdict.

This series isn’t theory—it’s high-stakes VC strategy laid bare.

What You’ll Discover in This Series:

Part I: Laying the Foundations

Setting the Stage: A historical primer on UK PE/VC evolution, the mystery we set out to solve, our four guiding research questions, the three‑stage field‑based methodology, and how each part of this series builds your ultimate VC playbook.

Part II: Decoding the VC Screening Playbook

Demystify the full VC playbook: From why they back pre‑revenue startups and how they outpace public markets, to the seven screening pillars that narrow hundreds of pitches down to the few they back—complete with data‑driven rankings and candid insights from four UK fund partners.

Part III: Unveiling the Findings & Discussion

Ecosystem Landscape

Map the UK frontier‑tech universe—517 funding rounds by 220 startups, backed by 33 domestic VCs. See sector breakdowns (crypto trading, FinTech, R&D services, security, IoT, AI, GovTech) and geographic clusters (87.9% London‑based).Deal Flow Sources

Discover the five deal‑sourcing playbooks VCs use—research‑driven outreach, problem–solution matching, inbound business‑plan funnels, networking referrals, and conference/university scouting—with verbatim fund‑partner insights.Pre‑Investment Process

Take a granular tour through each stage—from the first touchpoint (calls or Zoom) to multi‑hour site visits and ‘gear’ meetings—culminating in the Investment Committee’s GO/NO‑GO verdict and term‑sheet negotiation (see Figure 4.4).

Part IV: Mastering VC’s Art vs. Science

Unveil VC’s Ultimate Playbook: Uncover why VCs place founder & team quality above all else, how they rank and apply seven core screening pillars into a rigorous due‑diligence engine, the extra hurdles they set beyond the pitch deck, the unique curveballs of blockchain diligence, and how their role pivots post‑investment into network stewards rather than traditional board members.

This is the kind of intelligence we created 22nd Century Frontier to deliver: original research, untold insights, and decision-making frameworks you can’t find in public databases or news feeds.

Let’s dive into Part III.

Premium Bonus 🤖

Get on-demand access to two AI-powered bots—exclusive to Premium & Enterprise Members:

Investor Prep Question Generator: Enter any company name and receive five strategic questions to ask before your next investment meeting.

Intro Email Generator: Provide two names and instantly generate a polished, personalized introduction email.

(Check the end of the article for access.)

Table of Contents

4 Results and Discussion

4.1 Landscape

4.2 Deal flow sources

4.3 Pre-investment process

4 Results and Discussion

This research aims to contribute to the entrepreneurship literature by providing a clear collection of findings regarding how VCs make decisions. Thus the objective of this study is to understand and assess VC pre-investment process and identify the investment criteria used by investors. This research aim is addressed by four sub-questions:

1. Who are the UK-based blockchain start-ups and British VC firms that are active investors in the blockchain industry?

2. How does the VCs pre-investment process work?

3. Which investment screening and due diligence criteria do venture capitalists use in the evaluation of early-stage ventures and the team?

4. What is the difference in investment screening and due diligence for blockchain start-ups in comparison to investing in traditional start-ups?

The above sub-questions are researched through in-depth analysis of several publicly available secondary data sources following by semi-structured interviews with leading UK-based venture capitalists.

The results and discussion for each of the above questions are shown as follows:

4.1 Landscape

4.2 Deal flow sources

4.3 Pre-investment process

4.4 Pre-investment screening and due diligence criteria

4.5 Shows the pre-investment screening differences between blockchain start-ups and traditional ones

4.1 Landscape

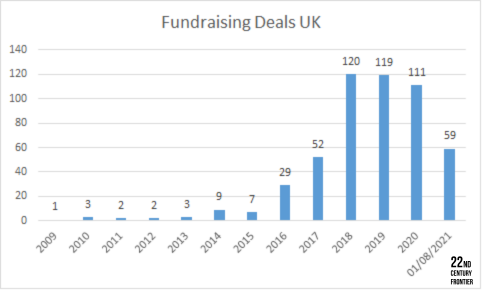

The first sub-question in this research sought to determine the UK blockchain start-ups and VC investors landscape. These were identified through in-depth analysis of various publicly available data sources. For the time period December 2009 until August 2021, 517 fundraising deals by 220 blockchain start-ups were identified, see Figure 4‑1 and a total of £1,1b was raised by UK-based blockchain start-ups. The different types of investments involved in these deals were Business Angels, Private Equity and Venture Capital, Corporate Investors, Local and Regional Government, Family Offices, and Crowdfunding.

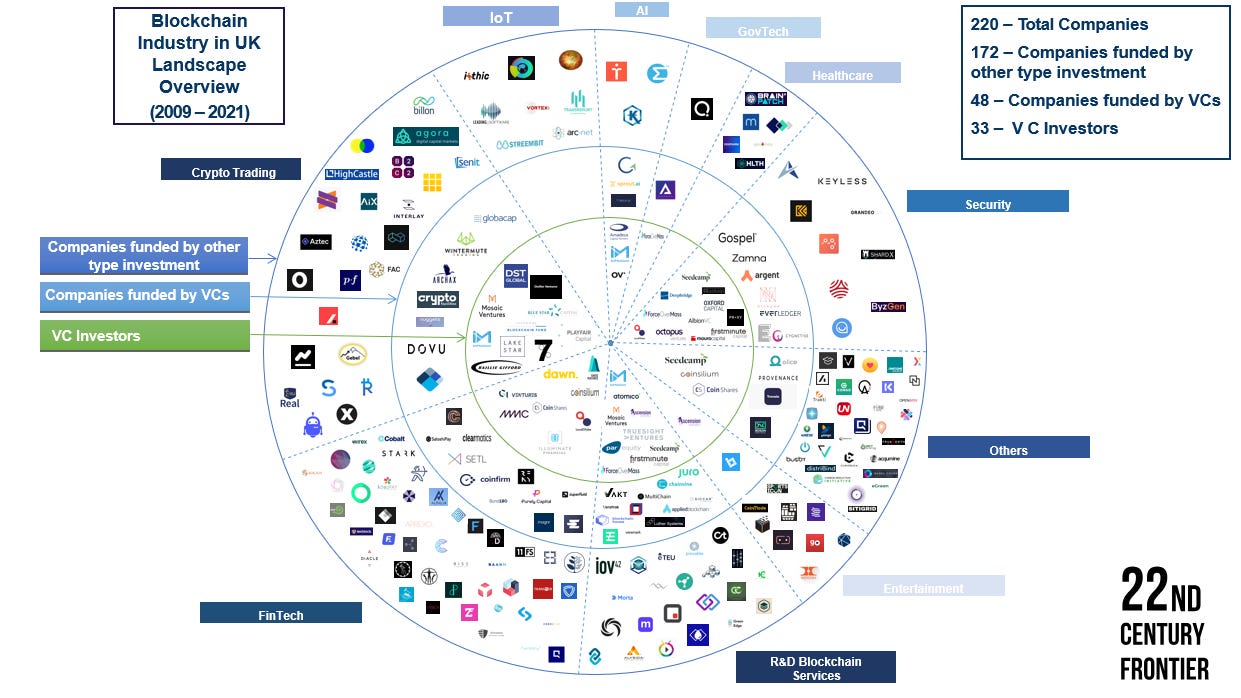

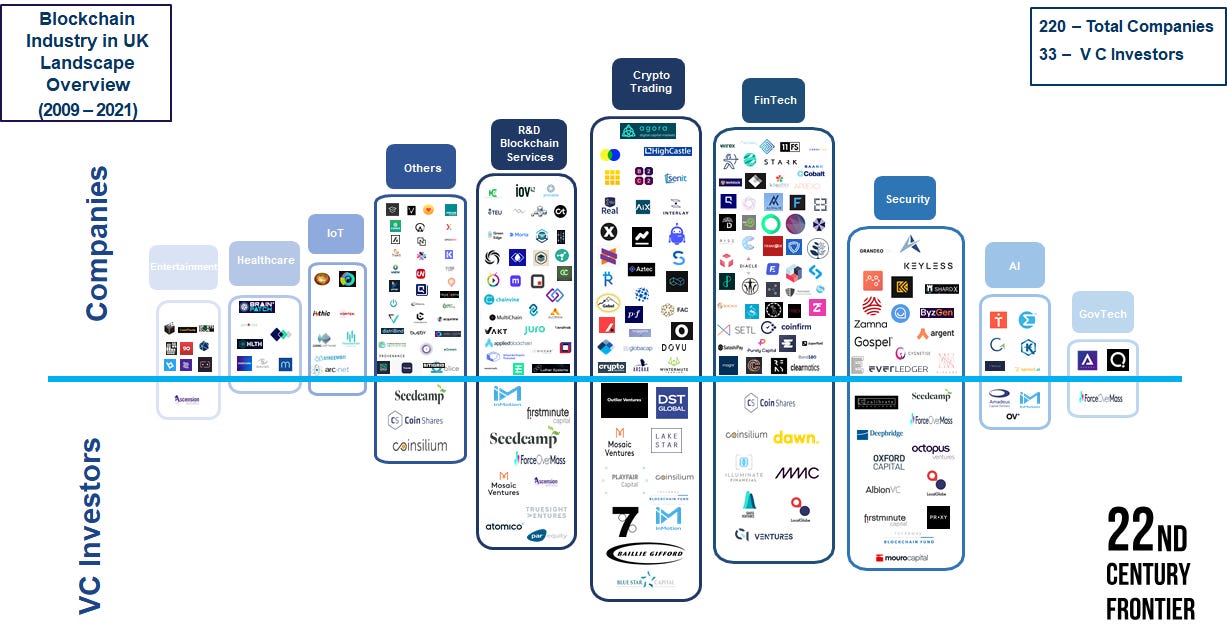

The 33 British VC firms who were involved in these deals were identified. Eight of these companies are within the Beauhurst's list of the 23 most active venture capital funds in London from 2011 until 2021 (Beauhurst, 2021a). Regarding the location, 29 (87.9%) of the VCs are based in London and the other remaining 4 (12.1%) across the UK: 1 – Cambridge, 1 – Oxford, 1 – Chester, and 1 – Edinburgh. They have backed 48 blockchain ventures: 42 (87.5%) are based in London, and the other 6 (12.5%) are located across the UK (2 - Edinburgh, 1 - Eccleston, 1 - Oxford, 1 - Bristol, and 1 – Cambridge). The identified blockchain start-ups involved different industries including crypto trading, R&D blockchain services, financial technology (FinTech), Security, Internet-of-Things (IoT), healthcare, artificial intelligence (AI), and government technology (GovTech), entertainment and others.

Figure 4‑2 and Figure 4‑3 show the UK-based blockchain start-ups and VCs investors landscape.

The results of the UK blockchain landscape findings are in line with the Deloitte (2016) report that has shown the potential for the rapid growth of blockchain technologies in the financial sector. This study's results further support the idea by providing insights of the most active sectors in the UK blockchain industry. The study showed that the most active start-ups and investors are into Crypto Trading, FinTech, R&D Blockchain Services and Security.

Blockchain start-ups fundraising deals have shown a rapid increase in the period 2017 - 2021. UK VCs have backed 21.8 % of the overall 220 blockchain start-ups that have raised funding from the period 2009 – 2021. London is the main location for blockchain start-ups and VCs that are active in the UK blockchain landscape. These findings will be of interest to entrepreneurs in identifying the active VC investors in each sector, and for VCs to identify who are the active start-ups and other VC firms with similar interest in the sector.

4.2 Deal flow sources

The second sub-question in this research aimed to provide insights on how the VCs pre-investment process work. Deal flow was identified as one of the most important factors in the beginning of the pre-investment process.

"There are two things to invest in as a venture capital, one is having deal flow, and the other is having capital. Getting the best deal flow is by far the most important criteria."VC1

The interviews revealed that the most common way for entrepreneurs to approach a venture capital firm to raise money for their venture is to send their business plan to the VC firm's website. The majority of those who were interviewed indicated that they receive hundreds of business plans every year from people that want to raise money from them.

VC2 stated "…We receive a lot of applications from our website, but the most interesting investments come usually from our network and from people and entrepreneurs we know, we have met, we talked to. Then, they introduced us to other entrepreneurs. I would say, networking is probably the most important source of deals…"

Some interviewees emphasised that they like to meet the entrepreneur very early, understand what he or she is trying to do, and then stay close to them and build a relationship. They stay in touch with them until the entrepreneurs are ready for the seed check.

"We get hundreds if not 1000s of business plans every year people are wanting to raise money from us, but most of the deals we do, we have actually gone out and we have searched for."VC1

A few participants stated that they go to industry conferences and judge on university panels. They try to meet entrepreneurs wherever possible.

Two different deal flow sourcing styles were identified – research based and business problem and solution concept.

"Our particular style is research-based. We publish on the sectors that we are really interested in. As part of that, we do a market map. We look at companies that are in that sector right now, and companies that come from that, we will then go and approach. The best deals are the deals that we go out and find, the next best deals, sometimes that can be also excellent deals, are the deals that somebody has read about our research."VC1

Another style applied by VC firms is the business problem and solution concept. The concept involves by first collecting industry pain points from the VC's industry network, then sifting through their venture pipeline of solutions or approaching new ventures who have been identified with the goal of finding the right fit for the specific industry problem. With this partnership model, the VC's industry network can help the venture to come to market by taking their solution and make it adoptable.

The study identifies different strategies that VCs use to find good investment opportunities such as: research-based approach by publishing for sectors that they are interested in and then approaching the identified successful targets, business problem and solution approach, receiving propositions directly from their website, networking and warm recommendations from people that they already know. This develops further previous academic study (Gompers et al., 2017) by presenting new insights with regard to deal flow sources.

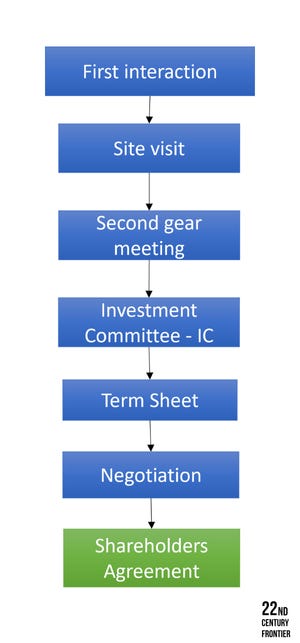

4.3 Pre-investment process

Venture capitalists tend to have a structural process when evaluating new venture proposals. Many of the VC firms are divided into different department teams within the company's areas, such as FinTech, Healthcare, Deep Tech, B2B Software.

The process begins with a first interaction via face-to-face meeting, Zoom meeting or a phone call between someone from the department team that is within this sector and the start-up team. "If it is really interesting, we really like the business, we will debrief as a team and we will say: Hey, we should spend some more time on this!" VC4

"If the feeling is good, and we feel that the company's team and the company market (target market), and what we have learned from the company is something that is enough for us to look further, then there will be further meetings. The feeling of that could be interesting opportunity is usually quite early."VC2

A follow-up in-person meeting called a site visit is conducted by some companies. That is when the deal lead and the second spend four or five hours with the venture team. "We talk about milestones, we get into the business model, financial model, looking at the product, technology, IP, sales and go to market strategy, team and hiring strategy…" VC4

At this time, the VC team perform market research, assess the competitive landscape, and conduct reference calls with customers (commercial) or with former employees or people who know the founders well (personal). "We want to understand the problem, understand What it is that you're trying to solve? Is that a big opportunity? Is that the team that can execute and deliver on that opportunity or not?"VC3

"We are trying to upskill ourselves in the industry as best we can and work out how we would be useful to them as well. We don't just give founders money, we like to give them much more than that." VC4

Another in-person meeting called the second gear meeting is then held by some firms. Within this meeting, the venture team meet with people from the wider team from other departments. In some VC firms, all of the Investment Committee (IC) members will be at this meeting. "By the time the investment committee looks at a deal, everybody on the investment committee would have already have met the entrepreneur." VC1

After the second gear meeting, the Investment Committee of the VC firm will make a GO/NO-GO decision on: Should they issue this business a term sheet? If it's a NO-GO, they move to Passed deals. If they move to pass, the VC team will contact the founders to give their detailed feedback. If it is a GO, the VC team will get the terms from the term sheet and then present it to the founder.

Generally, they have a two-way negotiation. Once the venture team sign the term sheet, the VC team start drafting the shareholders agreement.

The pre-investment process is shown in Figure 4‑4.

Previous literature indicates the generic structure of the pre-investment process (Gorman and Sahlman, 1989; Clercq, Fried, Lehtonen and Sapienza, 2006; Gompers et al., 2017). This research supports previous literature from this point of view and shows in-depth overview of the VC's pre-investment process structure and provides insights of what exactly is happening within each stage of the process. Interesting to note, the process was used by the larger VC firms, whereas the smaller ones were more ad hoc, following a unique approach for each venture. Some interviewees from the smaller VC firms mentioned that they do not follow a particular pre-determined meeting structure. Rather, they depend on a more open and flexible approach in regard to spending time with the founders prior to finalising investment decisions.

🔑 Unlock AI‑Powered Insights (Premium & Enterprise Members Only)

❓ Investor Prep Question Generator

Get five strategic questions to ask before your next investment meeting—just enter the company name. For example:

Explore key topics and strategic priorities for the company

Suggest areas to probe for growth acceleration

Analyze trends in company’s financial performance

Summarize key insights from latest earnings call

Verify figures reported in latest fillings

Help me learn to evaluate margin improvement plans

Compare company’s gwoth strategy to peers

Generate a high-level overview of recent company developments

Boil down highlights from recent company reports

Contrast recent deal activity with competitors

Create a list of strategic questions for management

and more!

✉️ Intro Email Generator

Instantly draft polished, personalized introduction emails—just provide two names. For example:

Investigate recent trends in business introductions

Recommend tools for automating email introductions

Analyze common mistakes in business introduction emails

Summarize feedback from executives on intro emails

Help me learn to structure a professional introduction

Contrast LinkedIn vs email for business introductions

Draft a sample itro email for two executives

Research best practices for professional email introductions

Analyze response rates to different intro email formats

Summarize best practices for email introductions

Fact-check claims about LinkedIn profile effectiveness

Teach me how to write a concise intro email

Compare formal vs informal into email styles

Create a template for a business introduction email

and more!

Remember: you can take a 7-day free trial.

Get Access to Your Premium Bots Below 🤖👇

Keep reading with a 7-day free trial

Subscribe to 22nd Century Frontier to keep reading this post and get 7 days of free access to the full post archives.