Teams Beat Solo Founders: Why Investors Favor Multiple Co-Founders (and You Should Too) 🚀

Being a brilliant solo founder is possible, but the odds tilt hard toward complementary cofounders

There is a powerful myth baked into startup culture.

The lone founder.

The solo genius.

The person who outworks, outthinks, and outlasts everyone else.

In the earliest days, that myth even looks true.

Speed is high.

Decisions are instant.

Progress feels exponential.

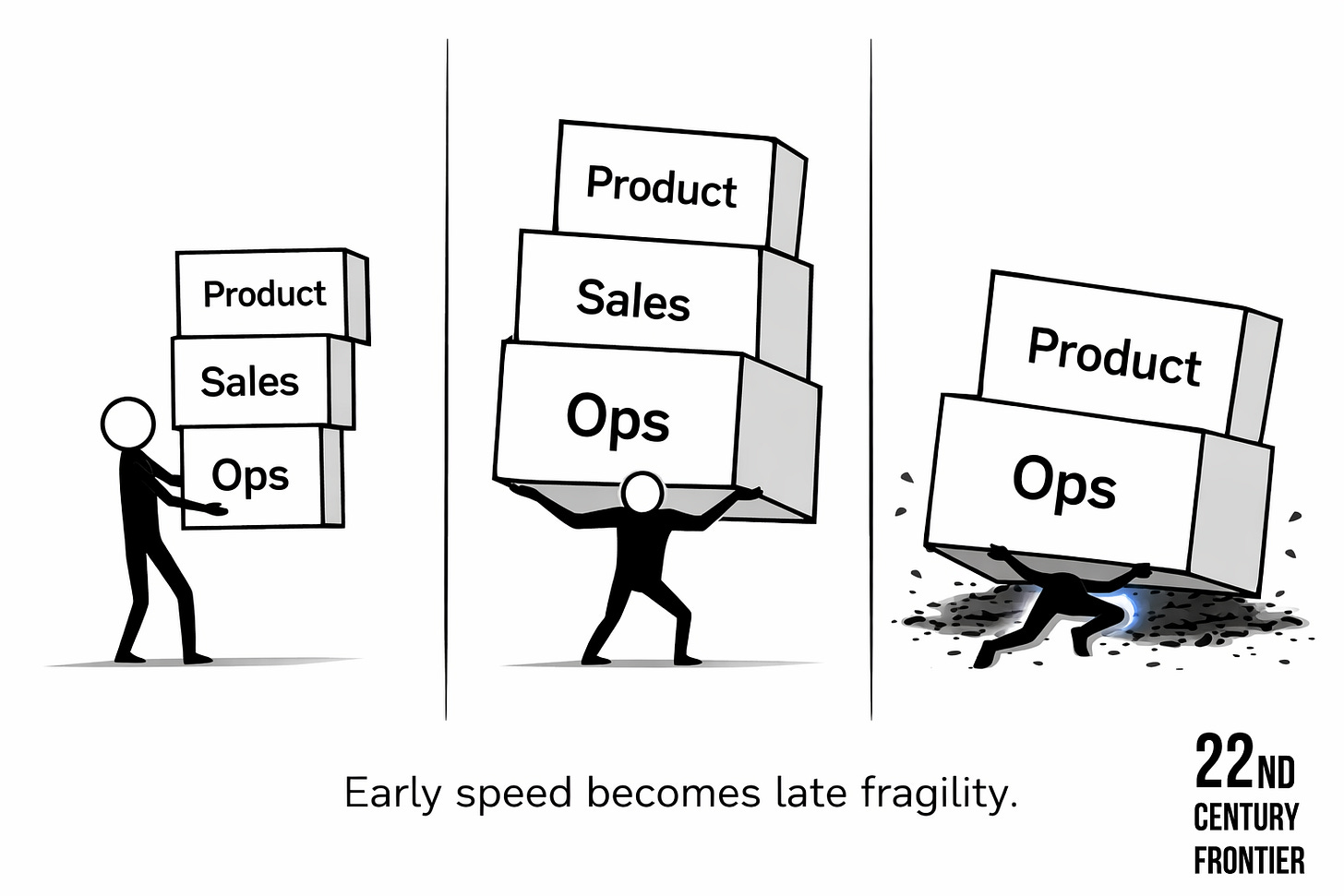

But scale has a way of exposing hidden costs.

Most startups do not fail because the idea was wrong or the founder was not capable. They fail because complexity grows faster than any one person can absorb.

What starts as independence quietly turns into fragility.

This piece is not an argument against ambition, control, or personal drive.

It is an argument for leverage.

If your goal is to build something that lasts, attracts serious capital, and survives real pressure, the question is not whether you can go it alone.

It is whether you should.

Sponsor Highlight: EuphoriaTech Group ✨

Your next growth sprint shouldn’t be guesswork. EuphoriaTech Advisory pairs founder-level strategy with hands-on execution to help startups and executive teams scale faster and smarter.

What they’re offering this week:

• Focused 30-minute 1:1 consultations — tactical, no-fluff sessions on Business Strategy & Scaling, Venture Capital Investments, LinkedIn Growth & Personal Brand, or any founder topic.

• Actionable outcomes: leave with prioritized next steps, a short roadmap, and testable experiments you can implement immediately.

• Who it’s for: founders, investors, senior operators, and execs seeking candid, practical guidance.

Key Takeaways

Startups do not fail because of bad ideas. They fail because one person becomes the bottleneck.

Investors back execution capacity, not individual brilliance.

Solo founders can start companies. Teams build enduring ones.

Complementary founders reduce risk across product, growth, and capital.

Equity shared early is cheaper than control lost later.

Table of Contents

The Solo Founder Fantasy

Where Solo Founders Actually Win

The Scaling Wall Most Founders Don’t See Coming

What Investors Are Really Evaluating

Real-World Examples That Don’t Get Talked About

Emotional Load and Founder Burn

The Ideal Early-Stage Founder Configuration

Final Thoughts: Control vs Compounding

1. The Solo Founder Fantasy

There is a deeply appealing narrative in tech culture:

The lone visionary, laptop open at 2 a.m., shipping faster than teams ten times their size.

It shows up everywhere.

Movies. X threads. Launch stories.

And early on, it works.

Speed feels intoxicating.

No alignment meetings.

No debates.

No compromises.

One brain, one direction, one voice.

But this is a phase advantage, not a scalable strategy.

Most companies do not break because the founder lacked intelligence or ambition. They break because complexity compounds faster than individual bandwidth.

2. Where Solo Founders Actually Win

To be fair, going solo does have real advantages in the earliest phase.

Clarity of vision.

There is no dilution of intent. The product feels coherent because it reflects one worldview.

Fast iteration.

Decisions happen instantly. The feedback loop is tight. This is especially powerful in developer-led or niche tools.

Capital efficiency.

You can delay hiring. You can bootstrap longer. You keep more equity early.

This is why many solo founders successfully reach product-market signal.

The problem is what happens next.

3. The Scaling Wall Most Founders Don’t See Coming

There is a moment, usually between early revenue and real growth, where everything breaks at once.

Customers want reliability.

Investors want predictability.

Employees want leadership.

Systems want structure.

Suddenly the job is no longer building.

It is prioritizing.

The solo founder becomes:

The approval layer

The escalation point

The culture carrier

The fundraising engine

This is what operators mean when they say “you are on the critical path of everything.”

No amount of hustle fixes this.

Time is the constraint.

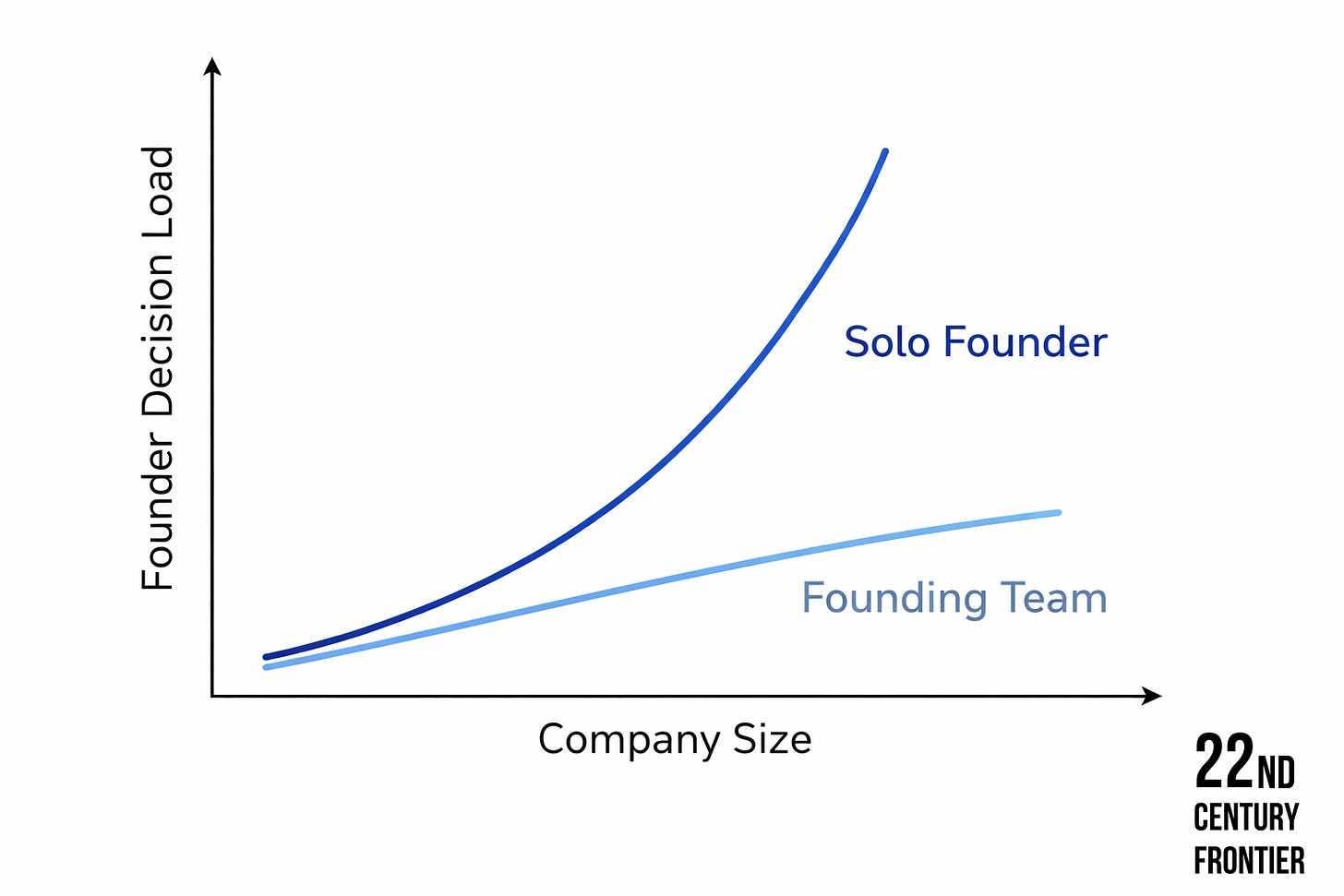

According to First Round Capital study, companies with multiple founders are significantly more likely to scale past early traction than solo-founded startups.

4. What Investors Are Really Evaluating

Investors are not asking:

“Is this founder smart?”

They are asking:

“Can this company function when this founder is not in the room?”

A solo founder raises silent questions:

Who owns growth when the CEO is fundraising?

Who challenges product assumptions?

Who runs operations when things break?

This is why investors often push solo founders to “round out the team” before or immediately after funding.

It is not bias.

It is risk math.

5. Real-World Examples People Misread

People love citing outliers.

Yes, Jeff Bezos started Amazon alone.

Yes, Elon Musk led companies aggressively.

What gets skipped is timing and resources.

Bezos raised capital early and built senior leadership fast.

Musk stepped into companies with deep technical teams already in motion.

A better comparison is modern SaaS and AI startups.

Companies like Stripe, Airbnb, and Canva were founded by small teams with complementary skill sets, not lone heroes.

Each founder owned a distinct vector: product, engineering, distribution.

This division of labor is not optional at scale.

It is structural.

6. Emotional Load and Founder Burn

This part rarely gets written about.

Running a company alone amplifies stress in non-linear ways.

There is no internal reality check.

No one to share responsibility for bad outcomes.

No one who understands the stakes at the same depth.

Teams distribute not just work, but psychological weight.

That matters more than most people admit.

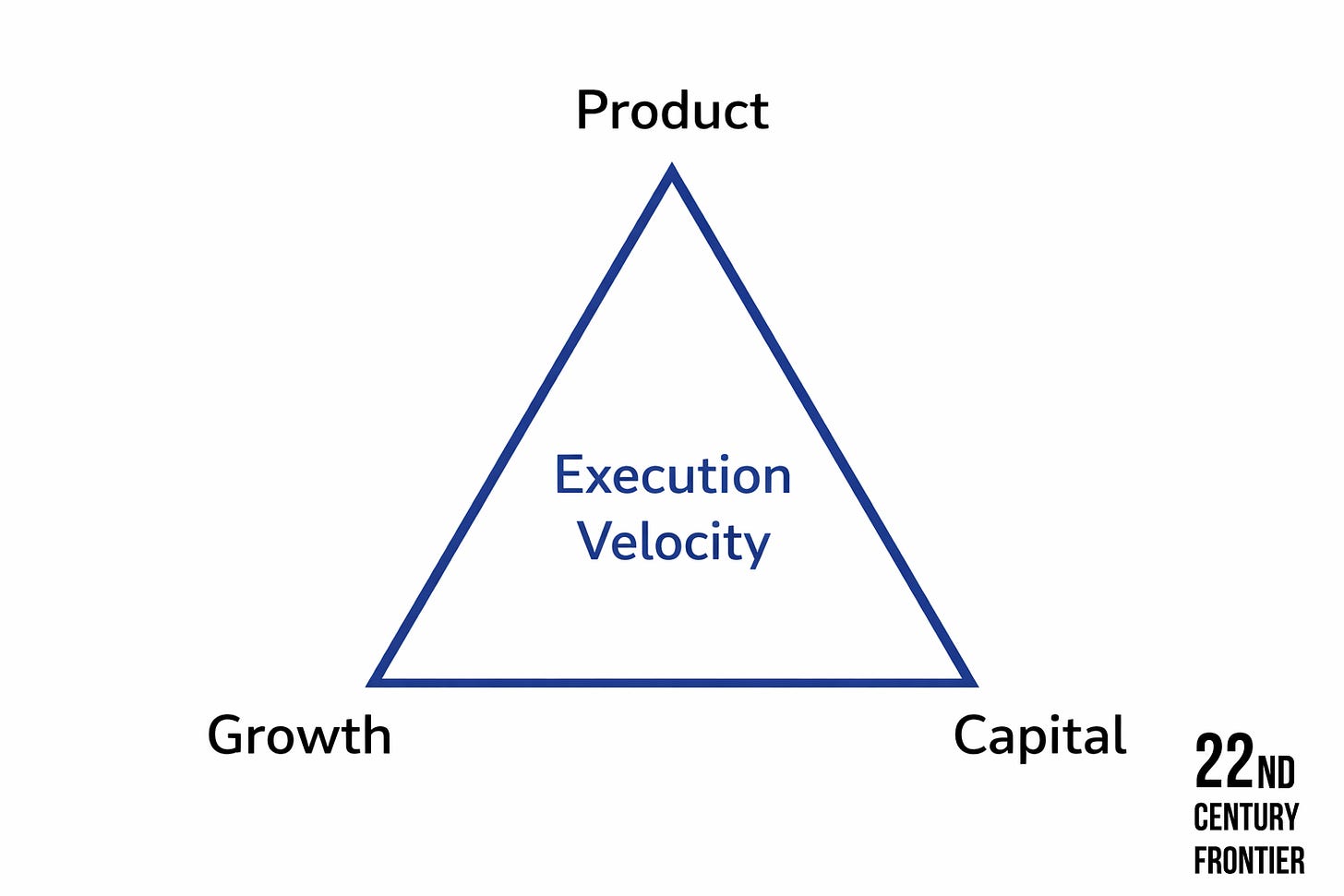

7. The Ideal Early-Stage Founder Configuration

There is no universal formula, but patterns emerge repeatedly.

The strongest early teams tend to have:

One founder focused on product and technology

One focused on growth and distribution

One focused on business, capital, and strategy

Clear ownership. Clear authority. Clear accountability.

This is not a democracy.

It is a designed system.

Equity aligns incentives. Trust enables speed. Debate improves decisions.

Three people aligned beats one person overwhelmed.

8. Final Thoughts: Control vs Compounding

Founders often resist adding partners because of control.

That instinct is understandable.

It is also expensive.

Control feels safe.

Compounding creates outcomes.

The goal is not to own the most of a small thing.

The goal is to build something that survives you.

Solo founders can start movements.

Teams turn them into institutions.

The real question is not whether you can do it alone.

It is whether doing it alone is worth the ceiling it creates.

Continue Exploring the Frontier

If this piece resonated, you may want to go deeper.

Here are three recent articles readers found especially useful:

Each one tackles a different part of the same challenge: building with intent, not hope.

If you are serious about shaping the future rather than reacting to it, you are exactly where you should be.

Petar, this is the kind of post that makes solo founders nod… then immediately argue with their screen like it’s a cofounder they still don’t have.

What landed for me is your framing that solo speed is a phase advantage, not a strategy. The “scaling wall” section is the real tell. Once customers want reliability and investors want predictability, one person becomes the critical path for everything, and hustle just turns into a nicer word for bottleneck.

Also appreciate you naming the psychological load. People debate cap tables like it’s math, but it’s also nervous systems. Control feels safe. Compounding actually ships.

Thank you for sharing! Solo founders always have difficulty to start a business. And at later stage, finding people that believe in your vision, continue on with a faith that keeps you going, to see that dream come true and often ask yourself “How hard can it be?”. I admired solo entrepreneurs, their spirit and dedication but nowadays with so much changing, you need all the AI and teams to be competitive in the global market.